There are a variety of deductions that can shield a company (or Individual) from paying Taxes. It allows them not only to conduct more significant investments but allows for tax optimization using Interest Tax Shield. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

LTM Revenue (and EBITDA) in 3 Steps – The Ultimate Guide (

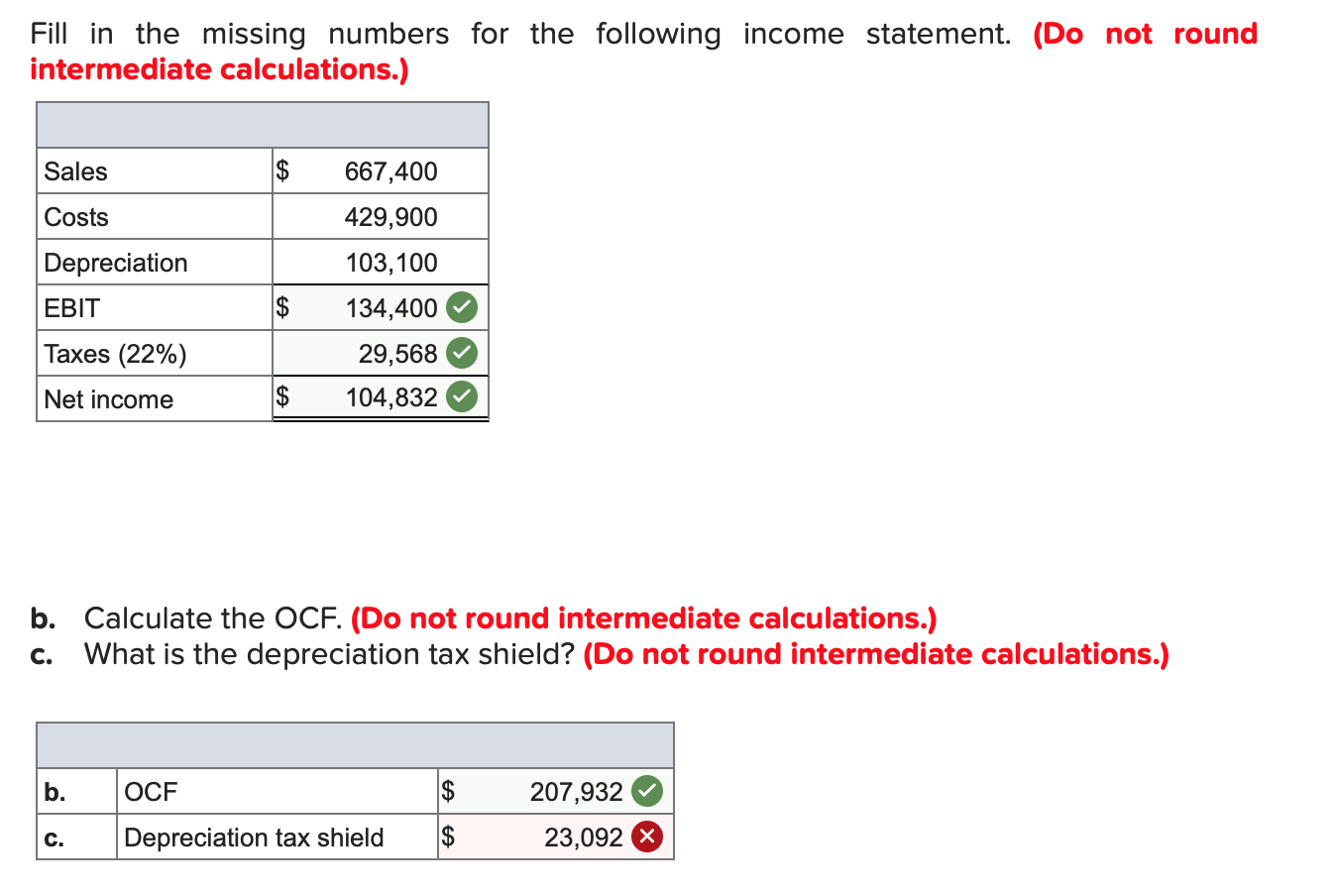

Under U.S. GAAP, depreciation reduces the book value of a company’s property, plant, and equipment (PP&E) over its estimated useful life. Let us consider an example of a company XYZ Ltd, which is in the business of manufacturing synthetic rubber. As per the recent income statement of XYZ Ltd for the financial year ended on March 31, 2018, the following information is available. As you can see above, taxes are $20 without Depreciation vs. $16 with a Depreciation deduction, for a total cash savings of $4. A tax deduction allows a company to increase its Net Operating Profit After Tax and helps it grow faster. A company is reviewing an investment proposal in a project involving a capital outlay of $90,00,000 in a plant and machinery.

Tax Shields for Medical Expenses

- The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses.

- This stipulation can reduce your tax bill more significantly than if you were to depreciate your assets over a prolonged period.

- Tax shields vary from country to country, and their benefits depend on the taxpayer’s overall tax rate and cash flows for the given tax year.

- Let us take the example of another company, PQR Ltd., which is planning to purchase equipment worth $30,000 payable in 3 equal yearly installments, and the interest is chargeable at 10%.

It is to be noted that the process reduces the tax burden for the tax payer but does not eliminate it completely. The concept is significant while making financial decisions in any capital-intensive business. Google company has an annual depreciation of $10,000 and the rate of tax is set at 20%, the tax savings for the period is $2000. As for the taxes owed, we’ll multiply EBT by our 20% tax rate assumption, and net income is equal to EBT subtracted by the tax. Because depreciation expense is treated as a non-cash add-back, it is added back to net income on the cash flow statement (CFS). In the final step, the depreciation expense — typically an estimated amount based on historical spending (i.e. a percentage of Capex) and management guidance — is multiplied by the tax rate.

Calculation Formula

The tax shield on interest is positive when earnings before interest and taxes, i.e., EBIT, exceed the interest payment. The value of the interest tax shield is the present value, i.e., PV of all future interest tax shields. Also, the value of a levered firm or organization exceeds the value of an equal unlevered firm or organization by the value of the interest tax shield. This a tax reduction technique under which depreciation expenses are subtracted from taxable income.is is a noncash item, but we get a deduction from our taxable income. This will become a major source of cash inflow, which we saved by not giving tax on depreciation.

Impact of Accelerated Depreciation on the Depreciation Tax Shield

Let’s explore how depreciation can benefit businesses in a simple and engaging way. Understanding the concept of deductible expenses and how the tax rate is applied is essential. Under the Section 179 tax deduction, you are able to deduct a maximum of $1,220,000 in fixed assets and equipment as a form of business expense.

Mortgage Calculators

An individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5% of adjusted gross income by filing Schedule A. Depreciation expense is an accrual accounting concept meant to “match” the timing of the fixed assets purchase—i.e. Capital expenditure (Capex)—with the cash flow generated from fixed asset over a period of time. However, when we calculate depreciation tax shield, even though the tax amount is reduced due to depreciation, the company may eventually sell the asset at a profit.

For example, because interest payments on certain debts are a tax-deductible expense, taking on qualifying debts can act as tax shields. Tax-efficient investment strategies are cornerstones of investing what are operating activities in a business for high net-worth individuals and corporations, whose annual tax bills can be very high. In many regards, you can consider Section 179 to represent a form of accelerated depreciation.

Those deductions lower the company or individual’s income tax in a given year. A tax shield on depreciation is the proper management of assets for saving the tax. A depreciation tax shield is a tax reduction technique under which depreciation expenses are subtracted from taxable income. Interest expenses are, as opposed to dividends and capital gains, tax-deductible. These are the tax benefits derived from the creative structuring of a financial arrangement.

Los comentarios están cerrados.